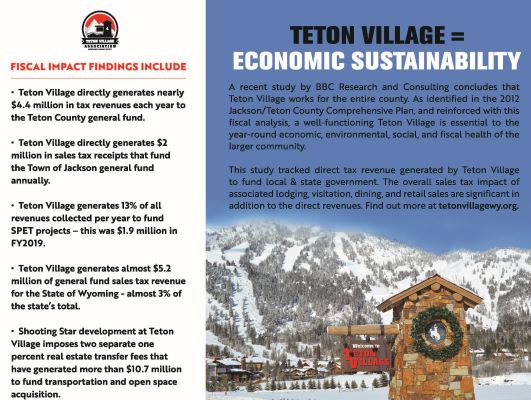

Teton Village elected officials recently updated a fiscal analysis to make sure that the Village continues to contribute to the fiscal health and long-term economic sustainability of the greater Teton County area and State of Wyoming. This study documents how the Village pays for the public services and infrastructure it uses while still managing to generate additional tax revenue for the State of Wyoming, Town of Jackson and Teton County.

The Teton Village Association retained BBC Research and Consulting to prepare a fiscal impact model and analysis of Teton Village’s effect on the County’s fiscal health in 2012. BBC’s most recent analysis reinforces results from previous studies and concludes that Teton Village continues to have a net positive effect on Teton County revenue and costs. It should be noted that this study tracks direct tax revenue generated by Teton Village to fund local government. This study does not track the overall sales tax impact produced by associated lodging, visitation, dining, retail sales and equipment rentals throughout the county.

On the revenue side, Teton Village offers a concentration of high value property, lodging sales and retail activity which make it a very productive source of ongoing Town, County and State tax revenue.

- Teton Village directly generates Teton County general fund revenues of more than $4.4 million per year in support of county services.

- Teton Village directly generates $2 million in sales tax receipts that fund the Town of Jackson general fund annually, up 45% from FY2014.

- Teton Village also generates 13% of all revenues collected per year to fund SPET projects – this was $1.9 million in FY2019.

- Teton Village generates almost $5.2 million of general fund sales tax revenue for the State of Wyoming – almost 3% of the state’s total.

2023 Teton Village Fiscal Impact Executive Summary

Teton Village Impact Analysis 2022 Update from BBC Research & Consulting